Act on the Dissolution of the Household of Cohabiting Partners (14.1.2011/26), the Cohabitation Act, entered into force in April 2011. The Act applies to the dissolution of the household of cohabiting partners, i.e. separation of the cohabiting partners’ property, when the partnership ends. Cohabiting partners are defined as partners who have been living in a relationship together in a shared household for at least five years. In addition. if the unmarried partners living in a shared household have, or have had, a joint child or joint parental responsibility for a child, the law applies without any time limit.

The law on cohabitation is in many respects of non-mandatory nature. However, the Cohabitation Act is intended to provide some protection in the event of a legal separation between cohabiting partners, particularly where the contribution made by one partner to the shared household during cohabitation would be left exclusively to the other partner.

The Cohabitation Act provides for the separation of property in the event of the dissolution of a cohabitation if the cohabiting partner or the heir of the deceased cohabiting partner so demands.

Under the main rule, the separation of property is simple because each cohabiting partner keeps his or her own property. If the cohabiting partners have joint property, co-ownership can be dissolved on demand. The separation of property can be agreed and documented by drawing a separation deed of the property, taking into account the form requirements of a distribution deed.

Either spouse can apply to the district court for an estate distributor to separate the property of the cohabiting partners if no agreement can be reached. The decisions of the estate distributor can be contested in the district court.

The Cohabitation Act gives a cohabiting partner the right to claim compensation in certain circumstances if, by his or her contribution to the shared household, he or she has helped the other partner to accumulate or retain his or her property. Such a contribution is, for example, work for the benefit of property owned by the other partner which cannot be regarded as insignificant.

The provisions of the Cohabitation Act are in many respects non-mandatory. However, the Cohabitation Act is intended to provide some protection for cohabiting partners at the end of their partnership, particularly where the contribution made by one partner to the shared household during cohabitation would otherwise be left solely to the other partner.

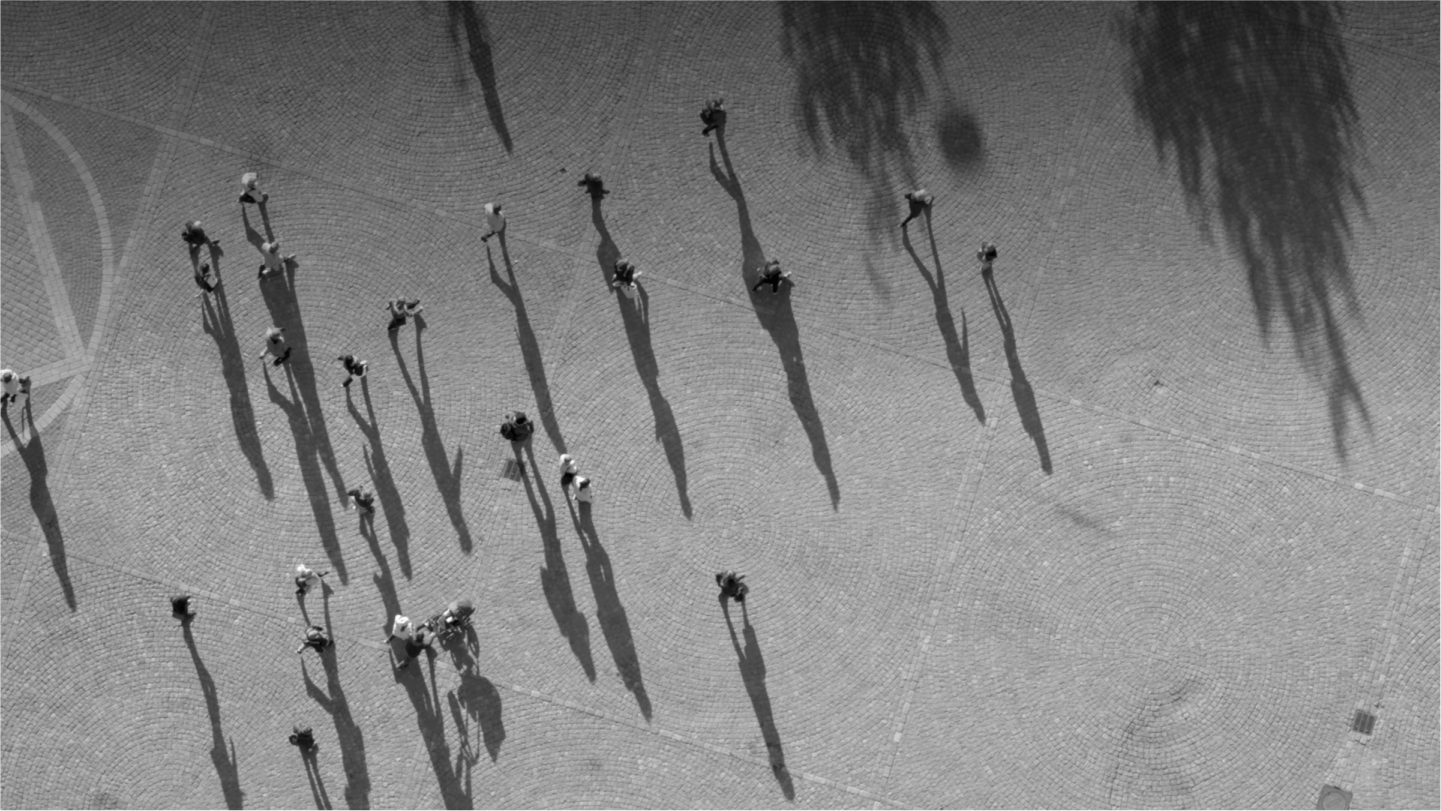

With more than twenty years of experience, we offer our clients a personalised and client-oriented service in various areas of family property law. Whether your matter falls under family law or inheritance law, we always handle it efficiently, without forgetting the human aspect.

The area of family law usually includes financial matters relating to marriage and cohabitation, as well as child custody, living arrangements, right of access and maintenance.

Before proceeding with the distribution of the estate, a deed of estate inventory, which is a list of the deceased’s assets and liabilities, must first be drawn up and the estate must be settled. Only then can an agreement on the distribution of the estate be concluded.

Inheritance tax planning emphasises the importance of properly prepared documents in good time. A continuing power of attorney is a document that allows you to take care of your own affairs over your lifetime well in advance. You can plan for the distribution of your assets and their tax treatment by having a comprehensive deed of gift and/or testament in place.