The Act on the Continuing Power of Attorney entered into force in November 2007 (Act on the Continuing Power of Attorney (25.5.2007/648). The power of attorney allows everyone to safeguard and decide on the management of their own affairs in case they become unable to manage their own affairs in the future, for example because of illness or health impairment.

By making a power of attorney, you can ensure that your affairs are later handled by someone close and trusted, rather than by a public guardian.

A continuing power of attorney enters into force once it has been confirmed by the guardianship authority (Digital and Population Data Services Agency). Confirmation can be sought whe the granter has, due to illness, mental impairment or health impairment or for some other equivalent reason, become incapable of managing the affairs covered by the power of attorney. It is therefore good to have a power of attorney in place to ensure that your affairs continue to be handled in the way you want them to if you are unable to do it yourself.

The power of attorney is made in writing, in the form prescribed by law, and therefore it is advisable to seek legal advice when drafting the document. In addition, a professional will be able to advise on the detailed content of the provisions and assess their impact on the individual case.

The power of attorney gives you a wide range of possibilities to determine the matters you want to entrust to the attorney. Generally speaking, the content of a continuing power of attorney is the management of economic and financial affairs, as well as the personal affairs of the granter.

A power of attorney can also be used for inheritance tax planning. For example, if provided in a continuing power of attorney, an attorney may be given a mandate to sell or create a lien on a real estate. In addition, notwithstanding the prohibition on donations in the Guardianship Act, a granter may authorise an attorney to donate his or her property. However, the provision of the power of attorney must be very precise and precise in this respect.

A power of attorney may also determine whether the attorney is entitled to receive remuneration for the management of the granter’s affairs and reimbursement of his or her expenses. One key aspect of particular relevance to the attorney is that the he or she is not obliged to submit an annual account of the performance of his or her duties to the Digital and Population Data Services Agency, if a power of attorney so provides.

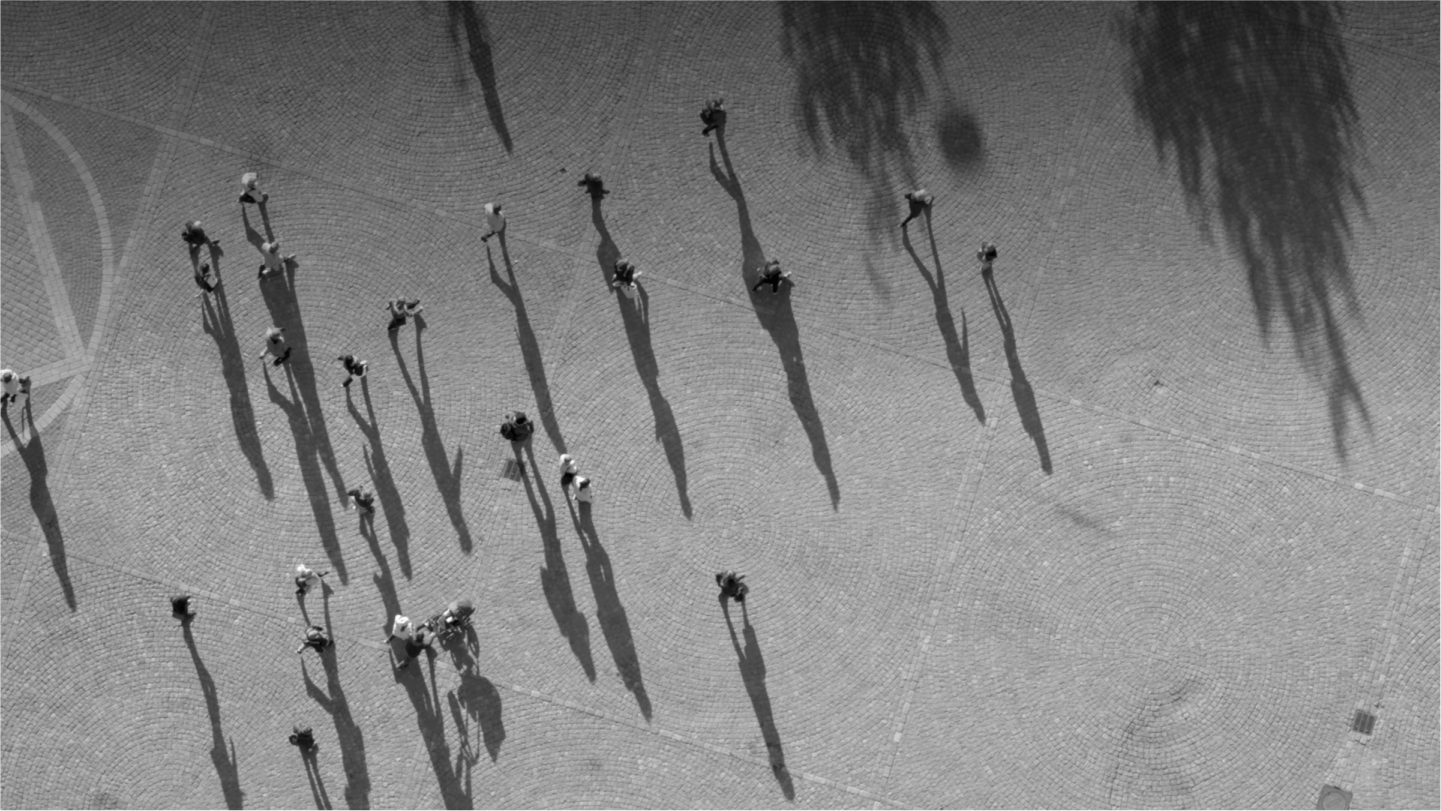

With more than twenty years of experience, we offer our clients a personalised and client-oriented service in various areas of family property law. Whether your matter falls under family law or inheritance law, we always handle it efficiently, without forgetting the human aspect.

The area of family law usually includes financial matters relating to marriage and cohabitation, as well as child custody, living arrangements, right of access and maintenance.

Before proceeding with the distribution of the estate, a deed of estate inventory, which is a list of the deceased’s assets and liabilities, must first be drawn up and the estate must be settled. Only then can an agreement on the distribution of the estate be concluded.

Inheritance tax planning emphasises the importance of properly prepared documents in good time. A continuing power of attorney is a document that allows you to take care of your own affairs over your lifetime well in advance. You can plan for the distribution of your assets and their tax treatment by having a comprehensive deed of gift and/or testament in place.